Acquisition, Scaling, and Reselling of a Wood Shop

Oct 15, 2023

Background:

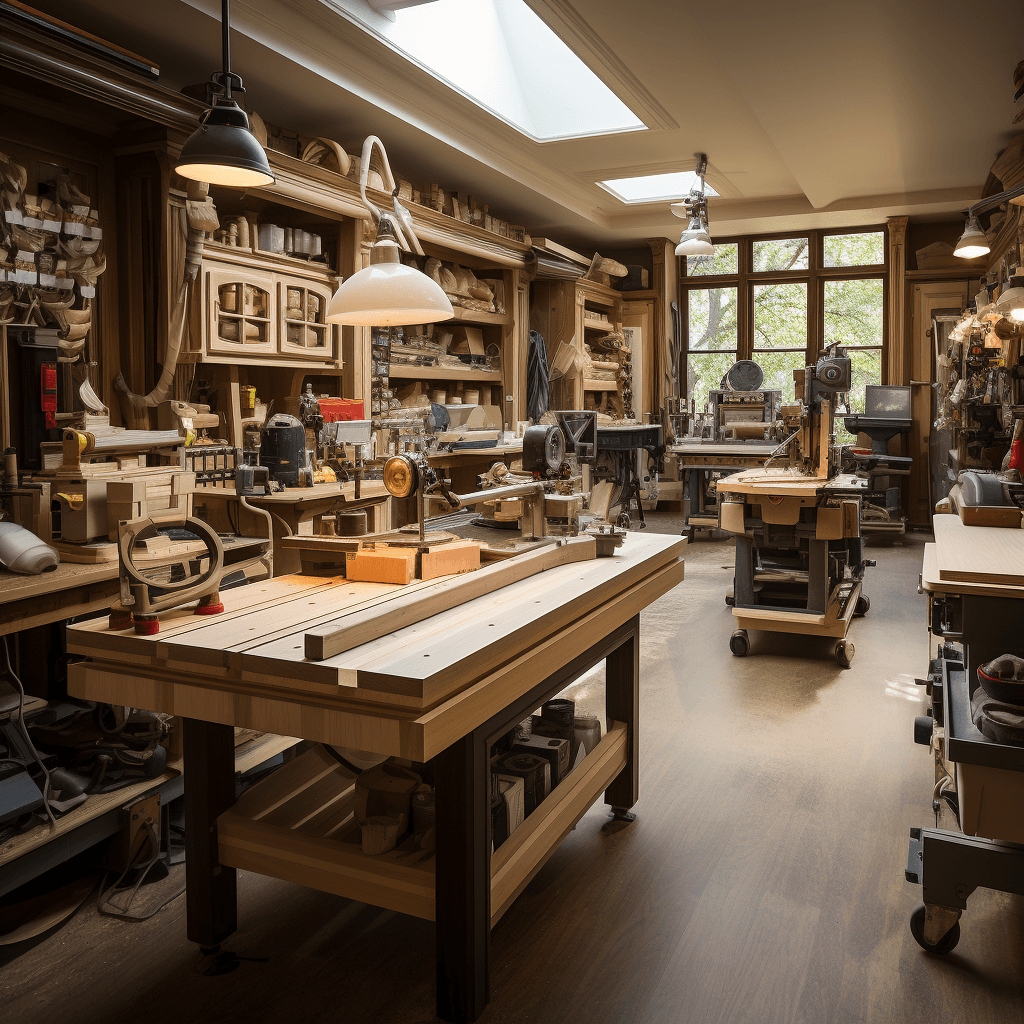

A business acquisition student, named Jordan, stumbled upon an opportunity to buy a renowned wood shop/millwork located in Austin, Texas. The enterprise had a remarkable history, with an exclusive e-commerce footprint and sales surpassing $1 million annually. Evaluating the business's metrics, its advanced management system, diversified product portfolio, commendable brand image, and e-commerce potential, Jordan ascertained its growth prospects.

Acquisition:

Jordan purchased the business for its asking price of $520,000, an attractive 2x EBITDA (cash to the seller before taxes or interest).

Strategies for Growth:

Amazon Reentry: Jordan reinstated the company's Amazon presence, leveraging the earlier $200k sales within 14 months.

Diversifying Commercial Framing: Fostered relationships with hospitality entities, educational bodies, and local government agencies, yielding projects with hefty margins.

Bolstering Private Label Manufacturing: With a focus on maintaining quality, Jordan engaged with larger clientele to ensure they didn't gravitate to subpar products, keeping the gross profit at 55%.

Highlighting Wholesale/Private Label: Capitalized on the company's stellar reputation to lure more bulk purchasers, thereby amplifying wholesale and private label revenues.

Optimal Resource Allocation: Deployed the cutting-edge management tools already in place to fine-tune processes, curtail wastage, and elevate operational efficacy.

Broadening Product Spectrum: Rolled out the 10 new products that were on the cusp of launch, enriching the product gamut and ensnaring a wider audience.

Results:

Year 1: A 25% YoY increment on the initial gross revenue of $950,000 led to a new revenue total of $1,187,500.

Year 2: 15% growth on Year 1’s revenue of $1,187,500 took it to $1,365,625.

Year 3: A notable 30% YoY growth pushed the revenue to a commendable $1,775,312.5.

EBITDA was $240,000 and the profit margins remained stable. By Year 3, EBITDA was $446,328.

Reselling:

After 3 years, Jordan decided it was time to capitalize on the business's enhanced value. With the newly attained EBITDA of $446,328 and a 3x multiplier, the valuation stood at approximately $1,338,984.

Net Gain:

Subtracting the original purchase price of $520,000 from the selling price of $1,338,984, Jordan realized a profit of roughly $818,984, not considering the earnings from the three years of operations.